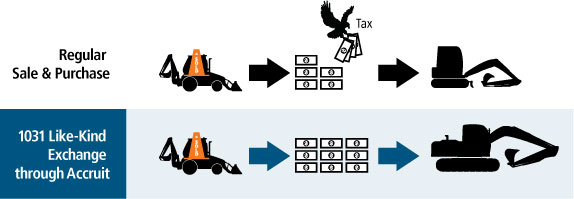

Find out how a 1031 Like-Kind Exchange can reduce your tax burden

If you have a business in the U.S. or are a U.S. taxpayer, the IRS can take a big chunk of your proceeds when you sell equipment and trucks – up to a whopping 40%.

Well, there’s a little section of the Internal Revenue Code that you may be able to put to good use: Section 1031 – Like-Kind Exchanges.

What is a 1031 Like-Kind Exchange?

More commonly used in real estate dealings, this handy tax strategy allows sellers to defer the tax on gains by re-investing them in another similar or “like kind” property.

Fortunately, the rules around Like-Kind Exchanges also apply to other kinds of assets used for business—including trucks and heavy equipment.

By re-investing the gains made from the sale of your old equipment into replacement models or similar gear, you can keep more of your cash for your business instead of the tax man.

You could even defer taxes indefinitely by continuing to replace equipment through Like-Kind Exchanges. It’s almost like getting an interest-free loan from the government.

There are some basic guidelines you need to follow though.

- The value of the replacement equipment must be equal to or greater than the value of the gear you sold

- All of the net proceeds from the sale of your old equipment must be used to acquire replacement equipment

- You must plan to buy replacement equipment within 6 months of selling your old machines

Take full advantage of Like-Kind Exchanges

As with any tax regulations, you need to know all the ins and outs in order to take full advantage of Like-Kind Exchanges without breaking the rules. And in the case of Like-Kind Exchanges, you have to use a qualified intermediary to help you facilitate the process.

Since 2007, Ritchie Bros. has partnered with Accruit LLC to facilitate Like-Kind Exchanges for our customers. Accruit have helped many of our customers keep more of their cash for their business as they re-invest in newer models and improved machinery. Accruit’s 1031 News blog is also full of articles detailing how 1031s have saved businesses millions of dollars.

Before you buy or sell your next piece of equipment or renew your fleet, find out if you qualify for a Like-Kind Exchange. Contact Accruit by phone +1.866.397.1031 or email info@accruit.com.

Update regarding changes to the 1031 like-kind exchange regime

Prior to 2018, Ritchie Bros. customers in the US were able to take advantage of tax deferred exchanges under section 1031 of the Internal Revenue Code when buying and selling equipment if they established a qualifying exchange agreement in connection with their transaction and replaced the equipment sold with qualifying replacement property of equal value. Such exchanges had the effect of minimizing tax liabilities by deferring gain on the sale of their equipment. The 1031 like-kind exchange regime for personal property was repealed on December 22, 2017 when amendments were made to the Internal Revenue Code by the Tax Cuts and Jobs Act (the “Act”). The good news is that for personal property, the Act effectively replaced the benefits of 1031 like-kind exchanges by a new provision allowing for full expensing of equipment placed in service by a business.

In short, this means that the Act, despite repealing 1031 like-kind exchanges for personal property, should not have any material impact on a customer’s ability to buy and sell equipment through an RBA auction in a tax efficient manner. In fact, in certain respects, the Act makes doing so easier and more flexible. Ritchie Bros. customers should consult with their tax advisors for details on how to take advantage of the new full expense deductions under the Act when selling equipment.

Learn more about Like-Kind Exchanges